MyExpense is the UCSF campus automated reimbursement system for employee travel and non-travel, and guest travel expenses.

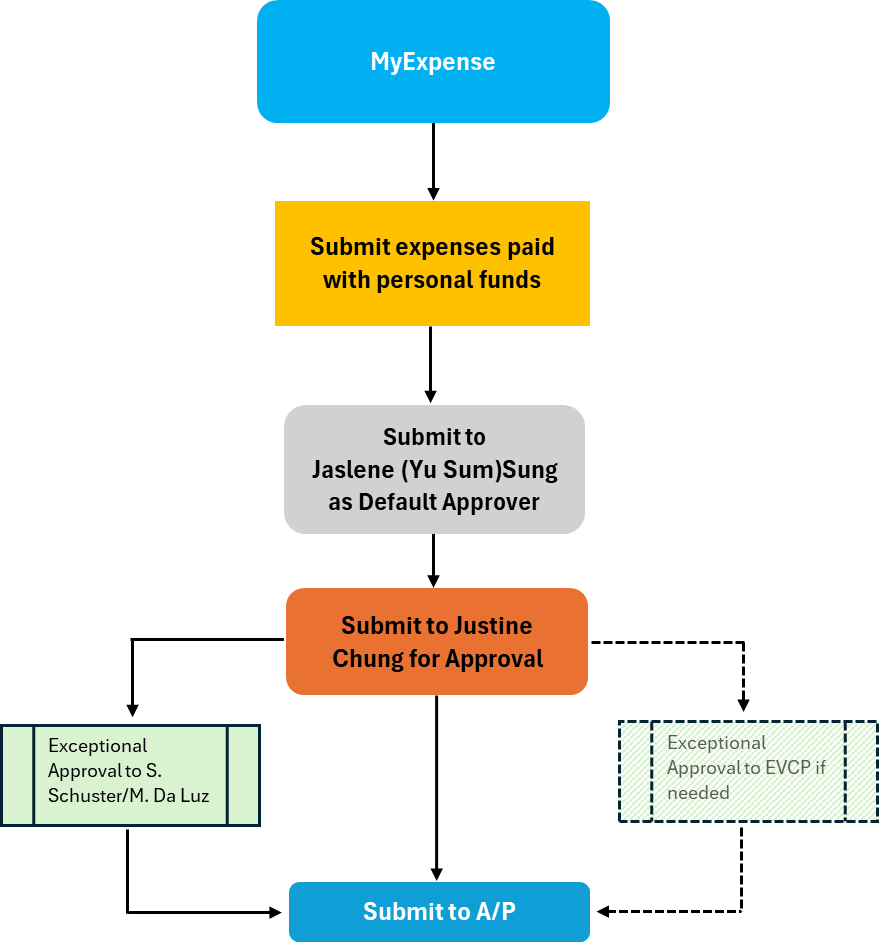

Process

Domestic Travel Meals & Incidentals Daily Rate

$92 per day is the maximum daily travel-related meals & incidental rate for business travel of less than 30 days within the continental United States (48 contiguous states and the District of Columbia) effective for travel that occurred on and after October 1, 2024 and submitted in MyExpense on or after October 30, 2024.

Late Expense Report Taxation

- All expense reports must be submitted in MyExpense within 45 calendar days from the end of the trip date/last purchase date:

- Expense reports submitted more than 60 calendar days after the end of the trip date/last purchase date will be reported as taxable income for the employee being reimbursed and will be subject to applicable payroll taxes.

- This policy applies to all reimbursements for any purpose, including purchases of supplies.

- For more information, see the article on Late Expense Reports.

- Employee being reimbursed is responsible for the timely reporting and submission of expense reports regardless of whether the employee:

- self-submits or

- has designated a delegate to submit expense reports

Helpful Links